Legal Steps to Take When a Commercial Tenant Damages Your Property

Property damage caused by a commercial tenant can lead to significant financial and legal challenges for landlords. Whether it’s structural damage, unauthorized alterations, or neglected maintenance, such incidents not only affect the property’s value but can also hinder its future use or leasing potential. It’s essential for landlords to understand the legal steps they should take to protect their investment and seek appropriate remedies.

1. Review the Lease Agreement

The first step is to carefully review the lease agreement. Most commercial leases contain specific clauses that outline tenant responsibilities related to property care, maintenance, alterations, and damage. These clauses typically require the tenant to return the property in its original condition (reasonable wear and tear excepted) and may include provisions for inspections, security deposits, or required repairs.

Understanding the terms of the lease will help determine whether the damage constitutes a breach and wh...

Nuisance Claims and Neighbor Disputes in Commercial Real Estate

Commercial real estate often brings together various stakeholders—property owners, tenants, developers, and neighboring businesses. While these relationships can be mutually beneficial, conflicts may arise, particularly in the form of nuisance claims and neighbor disputes. These disputes can affect the value, usability, and profitability of commercial properties, making it essential for stakeholders to understand their legal and practical implications.

What Is a Nuisance Claim?

In the context of commercial real estate, a nuisance claim typically involves an allegation that a property owner or occupant is interfering with the use and enjoyment of a neighboring property. This interference can be public—impacting a larger community—or private, affecting specific neighbors. Common sources of nuisance complaints include excessive noise, odors, vibrations, pollution, lighting, or obstructive signage. In commercial settings, issues may stem from restaurant exhaust systems, manufacturing noi...

Understanding CAM (Common Area Maintenance) Charges in Commercial Leases

When leasing commercial property, tenants often encounter Common Area Maintenance (CAM) charges. These charges cover the costs of maintaining shared spaces within a property, such as lobbies, hallways, parking lots, and landscaping. Understanding CAM charges is crucial for tenants and landlords alike to ensure transparency and fair allocation of expenses. This article explores the key aspects of CAM charges and their implications in commercial leases.

What Are CAM Charges?

CAM charges are additional costs paid by tenants in a commercial lease to cover the maintenance, repair, and upkeep of common areas shared by multiple tenants. These expenses ensure that the property remains functional, clean, and presentable. CAM charges typically include expenses for landscaping, security, property management fees, janitorial services, parking lot maintenance, snow removal, and utility costs for shared spaces.

Types of CAM Charges

CAM charges are generally classified into two types:

- Fixed CA...

How to Negotiate a Favorable Commercial Lease: Key Terms to Look For

Negotiating a commercial lease is a critical step for any business, as it directly impacts operational costs, flexibility, and long-term success. Whether you are leasing office space, retail premises, or industrial property, understanding key lease terms and how to negotiate them effectively can make a significant difference. Here’s what you need to know to secure a favorable commercial lease agreement.

1. Lease Term and Renewal Options

One of the most important factors in a commercial lease is the lease term. Consider whether a short-term lease (e.g., 1-3 years) or a long-term lease (5-10 years) best suits your business needs. Shorter leases offer flexibility, while longer leases may come with lower rental rates. Also, ensure the lease includes renewal options that allow you to extend the term under pre-agreed conditions.

2. Rent and Rent Escalation Clauses

Understanding the rental structure is crucial. Look for clauses detailing base rent, additional costs, and rent escalation....

What to Do If Your Landlord Won’t Make Repairs in a Commercial Property

Leasing a commercial property comes with responsibilities for both tenants and landlords. One of the landlord’s key obligations is to maintain the property and ensure it remains in a safe and functional condition. However, there are instances where landlords fail to make necessary repairs, causing inconvenience and potential financial loss to tenants. If you find yourself in this situation, here are the steps you can take to address the issue effectively.

1. Review Your Lease Agreement

The first step in resolving any repair dispute is to review your lease agreement carefully. The lease should outline the landlord’s obligations regarding maintenance and repairs, as well as the tenant’s responsibilities. Understanding these terms will help you determine whether the landlord is in breach of contract.

2. Notify the Landlord in Writing

If you identify a necessary repair, inform your landlord in writing as soon as possible. Clearly describe the issue, its impact on your business, and r...

Commercial Property Contracts: Key Legal Terms and How to Protect Your Interests

When dealing with commercial real estate, understanding the key legal terms in property contracts is crucial for protecting your interests and ensuring a smooth transaction. Whether you are a landlord, tenant, buyer, or seller, being familiar with these terms can help you avoid costly legal disputes and make informed decisions. Here are some essential legal terms and strategies to safeguard your commercial property investments.

Key Legal Terms in Commercial Property Contracts

Lease Agreement

A lease agreement is a legally binding contract between a landlord and a tenant that outlines the terms and conditions of the rental arrangement. Key elements include lease duration, rental amount, renewal options, and responsibilities for property maintenance.

Rent Escalation Clause

This clause specifies how and when rent will increase over the lease term. Rent escalations can be fixed (e.g., a set percentage increase annually) or tied to economic indicators like the Consumer Price Index (C...

Understanding ADA Compliance for Commercial Properties

The Americans with Disabilities Act (ADA) is a landmark civil rights law enacted in 1990 to ensure equal access and opportunities for individuals with disabilities. One crucial aspect of the ADA is its impact on commercial properties, mandating accessibility in facilities open to the public and places of employment. Compliance with ADA regulations is not only a legal obligation but also a step toward inclusivity and equity. This article provides an in-depth understanding of ADA compliance for commercial properties.

What Is ADA Compliance?

ADA compliance refers to adherence to the guidelines established under the ADA, particularly those outlined in Title III and Title I. Title III applies to public accommodations, including retail stores, restaurants, hotels, and offices, requiring them to be accessible to individuals with disabilities. Title I focuses on ensuring accessibility for employees with disabilities within the workplace.

Compliance encompasses the removal of architectural b...

Key Differences Between Residential and Commercial Real Estate Laws

Real estate law governs the buying, selling, leasing, and usage of land and property. While these laws generally apply to all property transactions, they vary significantly between residential and commercial real estate. These differences stem from the distinct purposes, stakeholders, and regulations that apply to each type of property. Below is a comprehensive exploration of these differences.

1. Purpose of Use

The most fundamental difference lies in the intended use of the property. Residential real estate involves properties intended for personal living, such as single-family homes, apartments, or condominiums. Commercial real estate, on the other hand, refers to properties used for business purposes, such as offices, retail spaces, warehouses, or industrial facilities.

The purpose of the property determines the applicable laws. Residential real estate laws prioritize protecting the rights of individuals and families, focusing on habitability, fair housing, and tenant rights. Com...

Commercial Lease Renewal Clauses: What Tenants Should Know

When leasing a commercial property, tenants often focus on initial terms like rent, location, and the length of the lease. However, one critical aspect that can impact long-term success is the commercial lease renewal clause. A well-structured renewal clause ensures tenants have an option to extend their lease under agreed-upon terms, providing business continuity and protecting them from abrupt relocations or rent hikes. Here’s what tenants should know about commercial lease renewal clauses to safeguard their interests.

1. Understanding the Renewal Clause

A lease renewal clause is a provision in the original lease agreement that gives the tenant the right, but not the obligation, to renew their lease for an additional term. It’s essential to understand that the renewal clause is not automatically included in every lease agreement; it must be explicitly negotiated and written into the lease. Typically, it includes details like how many renewal options the tenant has, the duration of ...

Discrimination Issues in Commercial Real Estate

Discrimination in commercial real estate is a significant concern that affects various aspects of the industry, from property transactions to leasing practices. Although much attention has historically focused on residential real estate discrimination, issues in the commercial sector are equally pervasive and impactful. These discriminatory practices not only perpetuate inequality but also hinder economic growth and development. Understanding the different forms of discrimination and how they manifest in commercial real estate is essential for addressing and mitigating these issues.

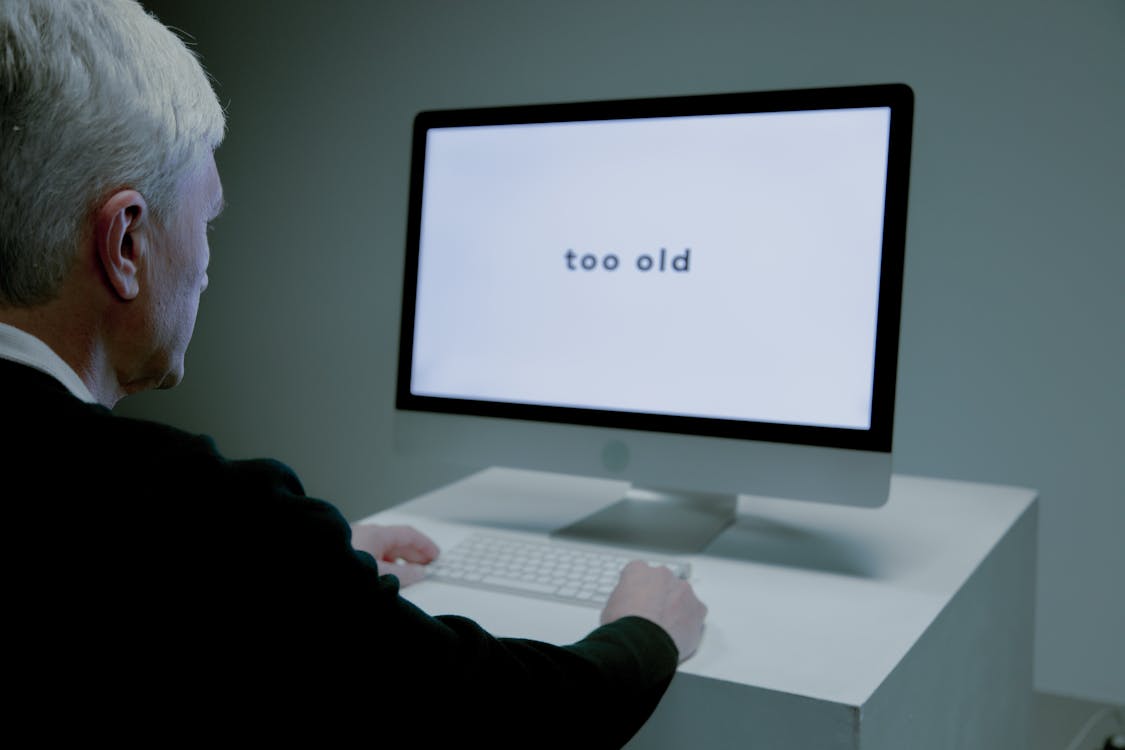

1. Types of Discrimination in Commercial Real Estate

Discrimination in commercial real estate can take various forms, including racial, gender, age, and disability discrimination. Racial discrimination is one of the most prevalent, with minorities often facing unfair treatment in leasing, purchasing, and financing commercial properties. For example, businesses owned by people of color may be denied leas...