Title Insurance for Commercial Real Estate: Is It Worth It?

When you’re closing a commercial real estate deal, the checklist feels endless. Appraisals, environmental reports, financing documents, inspections. In the middle of all that, title insurance can seem like just another expense added to the stack. So the real question is simple: is it actually worth it?

For most commercial buyers and lenders, the answer is yes. And here’s why.

What Title Insurance Actually Covers

Title insurance protects property owners and lenders from financial loss due to defects in a property’s title. That includes issues like undisclosed liens, unpaid property taxes, recording errors, forged documents, boundary disputes, or claims from unknown heirs.

In commercial real estate, the risks are often larger because the properties are more complex. A shopping center, office building, or industrial site may have decades of ownership history, multiple easements, prior financing arrangements, and layered legal agreements attached to it.

Even with a thorough title sear...

Identifying the Right Successor for Your Business: Family, Partners, or Key Employees?

At some point, every business owner faces the same question: what happens to this company when I step away? Whether you plan to retire, pursue a new venture, or simply prepare for the unexpected, choosing the right successor is one of the most important decisions you’ll ever make. The choice often comes down to three main options: a family member, a business partner, or a key employee. Each path has advantages and risks. The right answer depends on your goals, your company’s structure, and the people involved.

Passing the Torch to Family

Many owners naturally look to family first. There’s a sense of legacy, continuity, and pride in keeping the business in the family name. If you’ve built something from the ground up, it can feel meaningful to see your child or relative carry it forward.

But family succession only works if the person is both willing and capable. Interest alone isn’t enough. Does your family member understand the business model? Have they earned the respect of the tea...

How to Prepare Your Family for Estate Planning Conversations

Talking about estate planning with your family is rarely easy. The topic touches on money, mortality, responsibility, and sometimes long-standing family dynamics. Still, avoiding the conversation often creates more stress in the long run. When handled thoughtfully, these discussions can bring clarity, alignment, and real peace of mind.

Here’s how to prepare your family for estate planning conversations in a steady, practical way.

Start with the Right Perspective

Estate planning is not just about assets. It is about protecting the people you love and making sure your wishes are honored. Before starting the conversation, be clear about your intentions. You are not trying to control anyone. You are trying to reduce confusion and prevent unnecessary conflict later.

If you already have documents prepared, review them beforehand so you can explain them clearly. If not, consider meeting with an attorney to understand your options. Most estate plans include a will, possibly a revocable liv...

Legal Checklist for Opening a New Business in San Diego

Starting a business in San Diego is exciting. The city’s mix of tourism, tech, biotech, hospitality, and small business culture creates real opportunity. But before you open your doors, there are important legal steps to handle. Skipping them can lead to fines, delays, or even forced closure. Here’s a clear, practical legal checklist to help you launch the right way in San Diego.

1. Choose and Register Your Business Structure

Your first decision is your legal structure. Common options include sole proprietorship, partnership, LLC, and corporation. Many small business owners choose an LLC because it offers liability protection while remaining relatively simple to manage.

If you form an LLC or corporation, you’ll register with the California Secretary of State. Sole proprietors using a name different from their legal name must file a Fictitious Business Name (DBA) with San Diego County Clerk.

Read more: How to Choose the Right Legal Structure for Your Business

2. Apply for a Federal...

Fire Safety Regulations in San Diego: What Property Owners Must Know

San Diego’s warm climate and seasonal Santa Ana winds make it one of California’s most beautiful — and fire-prone — regions. For property owners, understanding fire safety regulations isn’t just about compliance; it’s about protecting lives, property, and the community. Whether you own a single family home, a multi-unit rental, or a commercial building, there are clear rules and smart steps you should take to reduce fire risk and stay within the law.

Why Fire Safety Matters in San Diego

San Diego County regularly sits at high risk for wildfires and brush fires. Dry conditions, low humidity, and strong winds can turn a small spark into a fast-moving blaze. This reality has shaped local fire safety policies, making prevention and preparedness key priorities for property owners.

California and Local Codes: The Basics

At the state level, the California Fire Code (CFC) sets minimum standards for fire prevention, alarms, sprinklers, exits, and hazardous materials. San Diego and other loc...

Flooded Property? What San Diego Landlords Must Do

Flooding can hit fast in San Diego. A winter storm, a broken pipe, or poor drainage can leave rental properties with standing water in a matter of hours. For landlords, the situation is stressful and expensive, but how you respond in the first 24 to 48 hours makes a major difference. Acting quickly protects your tenants, limits damage, and reduces legal risk.

Here’s what every San Diego landlord should know.

1. Prioritize Safety First

Before thinking about repairs, focus on safety. Standing water can hide electrical hazards, structural damage, and contamination. If water levels are significant, shut off electricity to the affected areas if it is safe to do so. In severe cases, tenants may need to temporarily vacate the property.

If the flooding is caused by sewage backup or storm runoff, treat the water as potentially hazardous. Professional cleanup may be required to prevent health risks.

2. Document the Damage

Take clear photos and videos of all affected areas immediately. Capt...

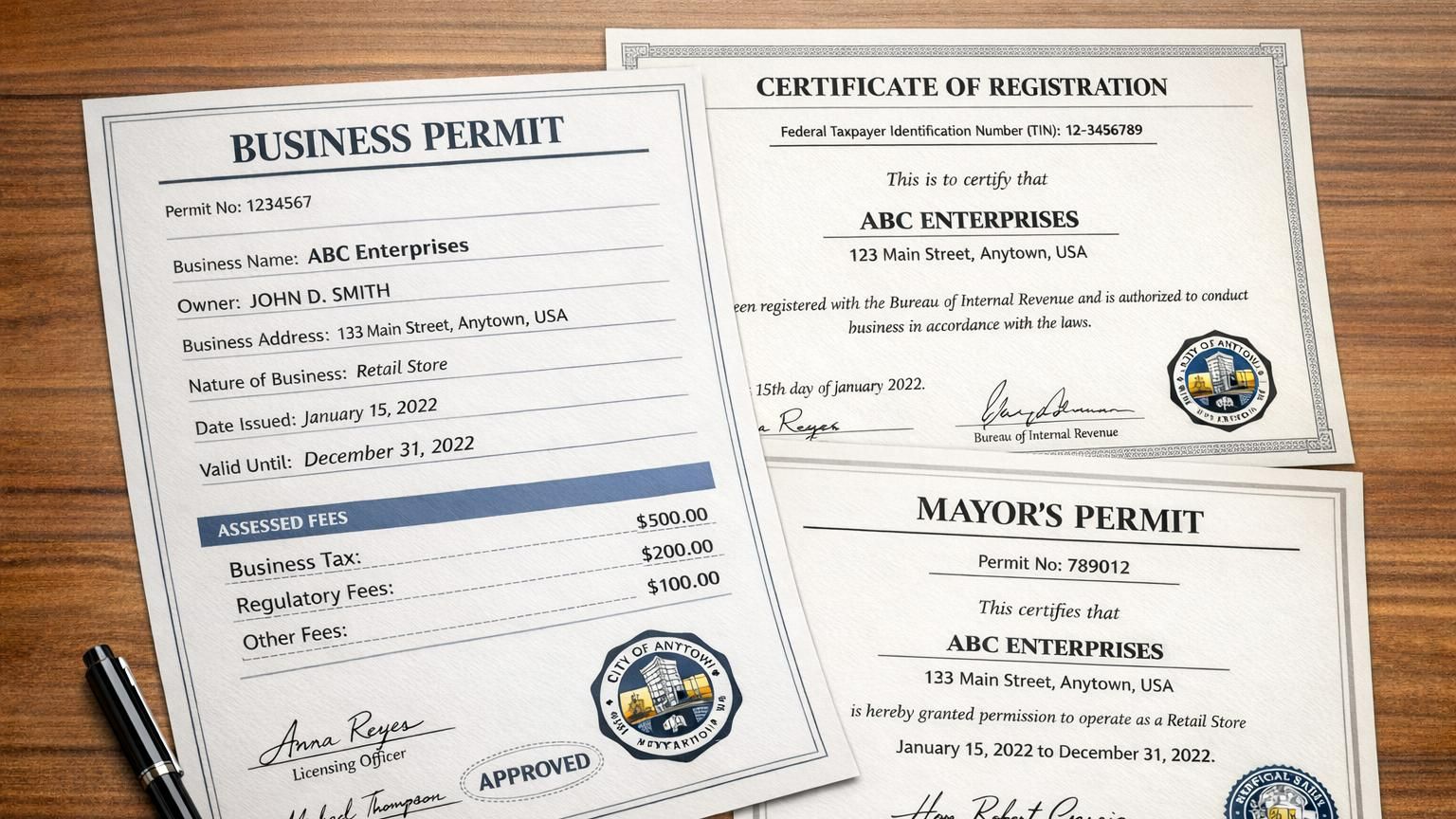

Why Proper Business Licenses and Permits Are Essential

Starting a business is exciting. You have an idea, a plan, and the motivation to make it work. In the rush to launch, licensing and permits can feel like annoying paperwork that slows everything down. But skipping or delaying them can create serious problems later. Proper business licenses and permits aren’t just formalities. They are a key part of running a legitimate, protected, and sustainable business.

Legal Compliance and Peace of Mind

At the most basic level, licenses and permits allow your business to operate legally. Different industries, locations, and services require different approvals, and those rules exist to protect both business owners and the public. Operating without the required permits can lead to fines, penalties, or even forced closure.

Having everything in place gives you peace of mind. You can focus on serving customers and growing your business without constantly worrying about inspections or compliance issues popping up unexpectedly.

Protecting Your Busine...

Why a Will Alone Isn’t Enough to Prevent Probate Disputes

A will is often seen as the ultimate safety net for your estate. You write down who gets what, sign the paperwork, and assume everything will unfold smoothly. In reality, having only a will can still leave plenty of room for confusion, conflict, and even courtroom battles. Probate disputes happen more often than people expect, and a will by itself doesn’t always stop them.

Here’s why.

Wills Still Go Through Probate

The first thing to understand is that a will does not avoid probate. In fact, probate is the legal process that proves a will is valid and oversees how assets are distributed. This process can be slow, public, and emotionally charged. During probate, family members or other interested parties have the opportunity to challenge the will. That’s often where disputes begin.

If someone believes the will is outdated, unfair, or improperly signed, they can raise objections. Even a clearly written will can end up under scrutiny once it enters the probate court.

Ambiguity Create...

What Happens When Family Members Disagree on Medical Care?

Medical emergencies are stressful enough. When family members disagree about what care a loved one should receive, that stress can quickly turn into conflict. These situations are more common than people realize, especially when decisions must be made quickly and emotions are running high.

Understanding how these disagreements unfold and how they’re usually resolved can help families navigate them with less damage and more clarity.

Why disagreements happen

Family conflict around medical care often starts with different interpretations of what’s best. One person may focus on preserving life at all costs, while another prioritizes comfort or quality of life. Past family dynamics, guilt, religious beliefs, cultural values, or unresolved relationships can also influence opinions. In many cases, disagreement isn’t about the medical facts but about fear, love, and the pain of potential loss.

The role of the patient’s wishes

When a patient has clearly documented wishes, such as a living ...

The Most Important Questions to Answer in Your Living Will

A living will isn’t just a legal document. It’s a way to speak for yourself when you can’t. If you’re ever seriously ill or injured and unable to communicate, your living will guides doctors and loved ones on what you want and what you don’t. The challenge is knowing what questions to answer clearly so there’s no confusion later.

Here are the most important ones to think through.

1. What kind of life-sustaining treatments do you want?

This is the core of a living will. You’ll need to decide how you feel about treatments like ventilators, feeding tubes, dialysis, or CPR. Would you want these used in all situations, only temporarily, or not at all if recovery isn’t likely? There’s no right answer here. Some people want every possible measure taken. Others prefer comfort-focused care if the outcome is unlikely to improve their quality of life.

2. How do you define “quality of life”?

This question is deeply personal, but incredibly important. Would you be comfortable living with sever...