Legal Steps to Take When a Commercial Tenant Damages Your Property

Property damage caused by a commercial tenant can lead to significant financial and legal challenges for landlords. Whether it’s structural damage, unauthorized alterations, or neglected maintenance, such incidents not only affect the property’s value but can also hinder its future use or leasing potential. It’s essential for landlords to understand the legal steps they should take to protect their investment and seek appropriate remedies.

1. Review the Lease Agreement

The first step is to carefully review the lease agreement. Most commercial leases contain specific clauses that outline tenant responsibilities related to property care, maintenance, alterations, and damage. These clauses typically require the tenant to return the property in its original condition (reasonable wear and tear excepted) and may include provisions for inspections, security deposits, or required repairs.

Understanding the terms of the lease will help determine whether the damage constitutes a breach and wh...

Nuisance Claims and Neighbor Disputes in Commercial Real Estate

Commercial real estate often brings together various stakeholders—property owners, tenants, developers, and neighboring businesses. While these relationships can be mutually beneficial, conflicts may arise, particularly in the form of nuisance claims and neighbor disputes. These disputes can affect the value, usability, and profitability of commercial properties, making it essential for stakeholders to understand their legal and practical implications.

What Is a Nuisance Claim?

In the context of commercial real estate, a nuisance claim typically involves an allegation that a property owner or occupant is interfering with the use and enjoyment of a neighboring property. This interference can be public—impacting a larger community—or private, affecting specific neighbors. Common sources of nuisance complaints include excessive noise, odors, vibrations, pollution, lighting, or obstructive signage. In commercial settings, issues may stem from restaurant exhaust systems, manufacturing noi...

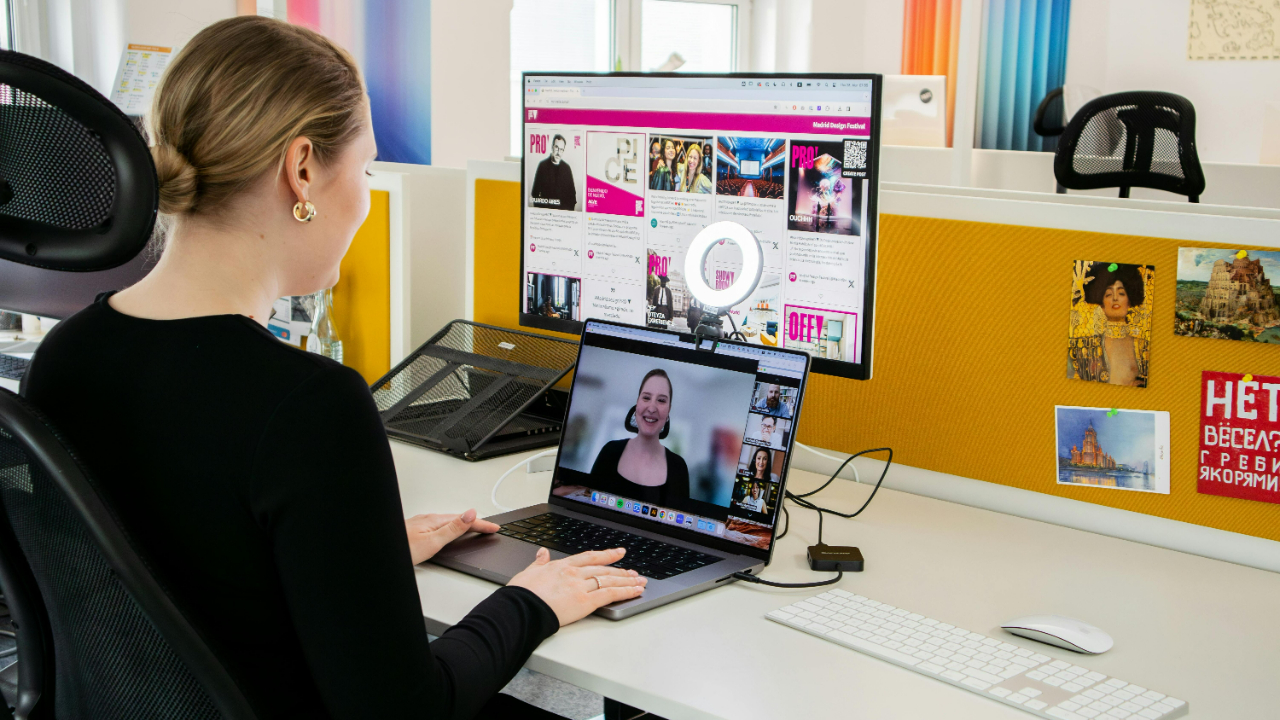

Key Legal Considerations for Managing a Remote or Hybrid Workforce

As remote and hybrid work arrangements become increasingly common, employers must navigate a complex legal landscape to ensure compliance with labor laws and protect both the organization and its employees. While the flexibility of remote work can enhance productivity and job satisfaction, it also introduces new legal challenges. Below are some key legal considerations for managing a remote or hybrid workforce effectively.

1. Wage and Hour Compliance

One of the most critical issues is ensuring compliance with wage and hour laws. Employers must accurately track work hours to avoid violations related to unpaid overtime or missed meal and rest breaks. This is especially important for non-exempt employees under the Fair Labor Standards Act (FLSA). Implementing reliable time-tracking tools and setting clear policies around working hours can help mitigate the risk of wage claims.

2. Tax and Jurisdictional Issues

Remote workers may live in a different state—or even country—than the comp...

Legal Challenges in Scaling Your Business: What Every Entrepreneur Should Know

Scaling a business is an exciting phase of entrepreneurship, but it also brings a host of legal challenges that can disrupt growth if not proactively managed. Entrepreneurs often focus on sales, hiring, and expansion during this stage, but overlooking legal compliance can lead to serious pitfalls. Understanding and addressing these legal hurdles is essential to building a sustainable and scalable enterprise.

1. Entity Structure and Governance

One of the first legal considerations when scaling is whether your current business structure remains appropriate. A sole proprietorship or simple partnership might work during the early stages, but as you grow, a limited liability company (LLC) or corporation offers better legal protection and more flexibility. For instance, incorporating can shield your personal assets from business liabilities and can also make it easier to attract investors. Alongside this, establishing clear bylaws, shareholder agreements, and operating procedures ensures s...

Can Landlords Deny Emotional Support Animals? Understanding Fair Housing Laws

Emotional Support Animals (ESAs) provide therapeutic benefits to individuals with mental or emotional disabilities. With mental health awareness on the rise, more tenants are seeking the right to keep ESAs in their homes. However, this raises an important question for landlords: Can landlords deny emotional support animals? The answer lies in understanding the Fair Housing Act (FHA) and related legal protections.

What Is an Emotional Support Animal?

Unlike service animals, which are trained to perform specific tasks for people with physical disabilities, ESAs do not require special training. Their primary role is to offer comfort and emotional support to individuals suffering from conditions like depression, anxiety, PTSD, or other mental health challenges. A licensed mental health professional must provide documentation verifying the need for an ESA.

The Fair Housing Act and ESAs

Under the Fair Housing Act (FHA), landlords are required to provide reasonable accommodations to tenan...

Common Causes of Tenant Injuries — and How Landlords Can Prevent Them

Landlords have a legal and ethical responsibility to ensure that rental properties are safe for tenants. Unfortunately, accidents and injuries can occur when property maintenance is neglected or when hazards go unaddressed. Understanding the most common causes of tenant injuries—and how to prevent them—can help landlords protect their tenants and reduce liability.

1. Slips, Trips, and Falls

One of the most frequent causes of injuries in rental properties is slipping or tripping due to unsafe conditions. Wet floors, uneven walkways, loose carpeting, and poorly lit staircases are common culprits.

Prevention Tips:

- Regularly inspect flooring, handrails, and lighting.

- Install non-slip surfaces in bathrooms and entryways.

- Fix loose tiles, torn carpets, or uneven steps immediately.

- Ensure outdoor walkways and staircases are well-lit and free of debris.

2. Faulty Stairs and Railings

Stairways and balconies can become dangerous if they are not maintained properly. Broken railings o...

Understanding CAM (Common Area Maintenance) Charges in Commercial Leases

When leasing commercial property, tenants often encounter Common Area Maintenance (CAM) charges. These charges cover the costs of maintaining shared spaces within a property, such as lobbies, hallways, parking lots, and landscaping. Understanding CAM charges is crucial for tenants and landlords alike to ensure transparency and fair allocation of expenses. This article explores the key aspects of CAM charges and their implications in commercial leases.

What Are CAM Charges?

CAM charges are additional costs paid by tenants in a commercial lease to cover the maintenance, repair, and upkeep of common areas shared by multiple tenants. These expenses ensure that the property remains functional, clean, and presentable. CAM charges typically include expenses for landscaping, security, property management fees, janitorial services, parking lot maintenance, snow removal, and utility costs for shared spaces.

Types of CAM Charges

CAM charges are generally classified into two types:

- Fixed CA...

How to Negotiate a Favorable Commercial Lease: Key Terms to Look For

Negotiating a commercial lease is a critical step for any business, as it directly impacts operational costs, flexibility, and long-term success. Whether you are leasing office space, retail premises, or industrial property, understanding key lease terms and how to negotiate them effectively can make a significant difference. Here’s what you need to know to secure a favorable commercial lease agreement.

1. Lease Term and Renewal Options

One of the most important factors in a commercial lease is the lease term. Consider whether a short-term lease (e.g., 1-3 years) or a long-term lease (5-10 years) best suits your business needs. Shorter leases offer flexibility, while longer leases may come with lower rental rates. Also, ensure the lease includes renewal options that allow you to extend the term under pre-agreed conditions.

2. Rent and Rent Escalation Clauses

Understanding the rental structure is crucial. Look for clauses detailing base rent, additional costs, and rent escalation....

What to Do If Your Landlord Won’t Make Repairs in a Commercial Property

Leasing a commercial property comes with responsibilities for both tenants and landlords. One of the landlord’s key obligations is to maintain the property and ensure it remains in a safe and functional condition. However, there are instances where landlords fail to make necessary repairs, causing inconvenience and potential financial loss to tenants. If you find yourself in this situation, here are the steps you can take to address the issue effectively.

1. Review Your Lease Agreement

The first step in resolving any repair dispute is to review your lease agreement carefully. The lease should outline the landlord’s obligations regarding maintenance and repairs, as well as the tenant’s responsibilities. Understanding these terms will help you determine whether the landlord is in breach of contract.

2. Notify the Landlord in Writing

If you identify a necessary repair, inform your landlord in writing as soon as possible. Clearly describe the issue, its impact on your business, and r...

How to Handle Business Partnership Disputes Without Going to Court

Business partnerships, like any relationship, can experience conflicts. Disagreements over finances, responsibilities, or company direction can arise, threatening the stability of the business. While litigation is an option, it is often costly and time-consuming. Instead, partners should explore alternative methods to resolve disputes efficiently and amicably. Here are key strategies to handle business partnership disputes without going to court.

1. Establish Clear Communication

Effective communication is the foundation of conflict resolution. Partners should set aside emotions and engage in open and honest discussions. Scheduling a private meeting to address concerns calmly and professionally can often prevent conflicts from escalating. Using active listening techniques and focusing on solutions rather than blame fosters a cooperative atmosphere.

2. Refer to the Partnership Agreement

A well-drafted partnership agreement outlines each partner’s rights, responsibilities, and dispute...