Home Inspection Contingencies: What They Really Mean

Buying a home often comes with a long list of paperwork, and one of the most important items is the home inspection contingency. While it can sound technical or intimidating, this clause plays a key role in protecting buyers and setting expectations for sellers. Understanding what it really means can help both sides navigate the transaction with fewer surprises.

What Is a Home Inspection Contingency?

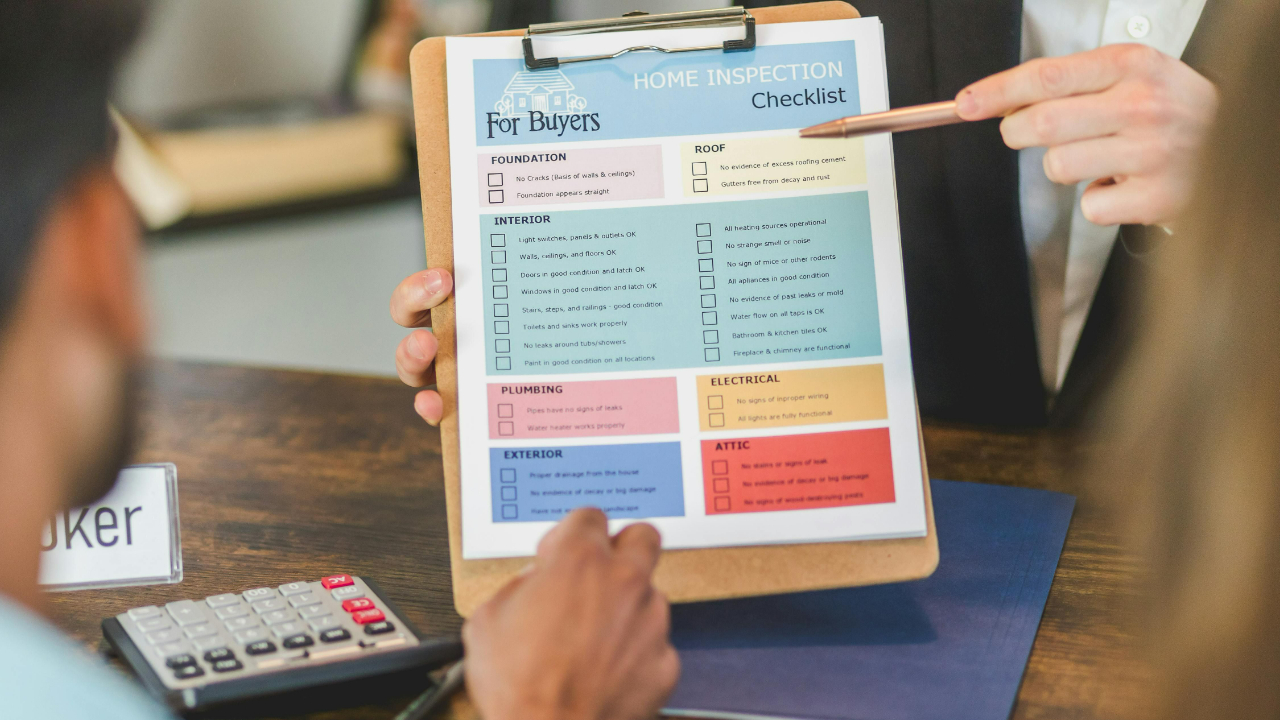

A home inspection contingency is a clause in a purchase agreement that allows the buyer to have the property professionally inspected within a specific timeframe. If the inspection reveals issues the buyer finds unacceptable, this contingency gives them options. They can request repairs, ask for a price adjustment, negotiate credits, or, in some cases, walk away from the deal without losing their earnest money.

This contingency is not about finding a “perfect” home. It is about understanding the condition of the property before fully committing to the purchase.

What the Inspection Typi...

What Buyers Should Know Before Signing a Residential Real Estate Contract

Buying a home is exciting, but the contract you sign carries long-term legal and financial consequences. Before putting your name on a residential real estate agreement, it’s important to understand what you’re committing to and where you still have room to protect yourself. A few careful reviews upfront can prevent expensive surprises later.

Understand the Purchase Price and Payment Terms

The purchase price may seem straightforward, but buyers should also review how and when payments are due. This includes the earnest money deposit, down payment, and final payment at closing. Make sure the amounts and deadlines align with your financing plan.

Pay close attention to what happens if deadlines are missed. Some contracts allow extensions, while others may put your deposit at risk. Knowing these terms helps you avoid accidental breaches.

Review Contingencies Carefully

Contingencies are your safety net. Common ones include financing, home inspection, appraisal, and sale-of-current-home...

How to Ensure Your Rental Meets Safety and Building Code Standards

Renting out a property isn’t just about keeping it occupied and profitable—it’s about keeping it safe. Tenants trust that the home they’re living in meets building codes, fire regulations, and basic safety standards. If something goes wrong, you’re the one on the hook legally and financially. The good news? Staying compliant is easier than it sounds when you know what to look for and stay consistent with maintenance.

Here’s how to make sure your rental property checks all the right boxes.

1. Start With a Full Property Inspection

Before welcoming tenants, get a detailed inspection. You can do this yourself if you’re knowledgeable, but hiring a licensed inspector gives you a clearer picture and helps you catch issues you might overlook. They’ll review structural integrity, electrical systems, plumbing, roofing, ventilation, and more. Think of it as your baseline: once you know what needs attention, you can start making fixes.

2. Know the Local Building Codes

Every city has its own s...

HOA Fines: What You Can Challenge and How to Protect Your Rights

Living in a community with a homeowners association (HOA) can offer perks—cleaner common areas, well-kept neighborhoods, and shared amenities. But it also comes with rules, and sometimes, fines. While many violations are legitimate, not all HOA penalties are set in stone. As a homeowner, you have the right to question unfair charges and make sure the association follows the law and its own governing documents. Here’s what you can challenge and how to protect yourself in the process.

1. Fines That Aren’t Backed by Written Rules

Your HOA can only fine you for violations that are clearly stated in the community’s governing documents—usually the Covenants, Conditions, and Restrictions (CC&Rs), bylaws, or official policies. If the rule isn’t written down or the fine isn’t authorized, you can dispute it. Ask for a copy of the rule and the section where your supposed violation is defined. If they can’t point to it, the fine may not hold.

2. Fines Issued Without Proper Notice

Most states r...

Landlord Legal Checklist for the End of the Year

As the year wraps up, landlords often focus on taxes, maintenance, and tenant renewals—but it’s also the perfect time to make sure your rental business is legally buttoned up. A few simple checks now can help you avoid fines, disputes, or legal surprises later. Whether you manage one unit or several, this year-end legal checklist will help you close the year on solid ground.

1. Review Your Lease Agreements

Start by pulling out your active leases and reviewing the details. Make sure each lease is current, signed by all parties, and includes any updates that reflect your property’s latest policies or local regulations. Check renewal dates and notice periods, and confirm that rent increases (if any) comply with your area’s rent control or notice laws. If you’ve used different versions of lease templates over time, consider standardizing them for consistency going forward.

Read more: Common Mistakes in Drafting Lease Agreements for Rental Properties

2. Verify Tenant and Property Reco...

Avoid Last-Minute Legal Surprises When Selling Your Home

Selling a home can feel like an emotional and financial marathon. Between cleaning, staging, and negotiating with buyers, it’s easy to forget that the legal side of the process can trip you up at the finish line. Many sellers assume that once they find a buyer, it’s smooth sailing—but unexpected legal issues can delay or even derail the sale. If you want to close with confidence, it’s essential to prepare early and understand what legal pitfalls to avoid.

1. Double-Check the Property Title

One of the most common last-minute problems is a title issue. You might not even know there’s a problem until it surfaces during escrow. Liens, unpaid taxes, boundary disputes, or missing signatures from co-owners can all prevent a clean title transfer. Before listing your home, order a preliminary title report or ask your agent to help you get one. If anything unusual shows up, you’ll have time to resolve it instead of scrambling right before closing.

2. Review Your Disclosures Carefully

Every...

Handling Tenant Complaints: Best Practices for California Landlords

Tenant complaints are part of managing any rental property, but how you handle them can make or break your relationship with tenants—and even your reputation as a landlord. In California, where tenant protection laws are particularly strong, addressing issues promptly and professionally isn’t just good practice—it’s essential. Here’s how landlords can handle complaints effectively, stay compliant, and maintain a positive rental environment.

1. Encourage Open and Easy Communication

The first step in handling tenant complaints is making it easy for tenants to reach you. Provide clear contact information and multiple ways to report issues—whether by phone, email, or through a property management portal.

Encouraging tenants to report problems early prevents small issues from turning into big ones. A leaking faucet, for instance, is a simple fix today but could become a costly water damage claim if ignored. More importantly, being responsive builds trust. Tenants who feel heard are more ...

The Legal Benefits of Using Escrow in Transactions

When money and property change hands—whether it’s a real estate deal, a business purchase, or even an online sale—trust becomes the cornerstone of the transaction. But trust alone isn’t always enough. That’s where escrow steps in. Escrow offers a neutral, legally protected space where both parties can safely complete their side of the agreement before any funds or assets are released. It’s not just a convenience—it’s a legal safeguard that protects everyone involved.

What Is Escrow?

At its core, escrow is a legal arrangement in which a neutral third party holds funds, documents, or assets until all agreed-upon conditions are met. Think of it as a digital or legal “holding pen.” The escrow agent (or company) follows the terms laid out in the contract and only releases the assets once both sides fulfill their obligations.

Escrow is commonly used in real estate, business acquisitions, online marketplaces, and intellectual property transfers, but its protection applies to any transactio...

Buying a Home? Here’s What Sellers Are Legally Required to Tell You

Buying a home is one of the biggest financial decisions most people make, and the excitement of finding “the one” can sometimes overshadow important details. While it’s true that buyers are expected to do their own due diligence through inspections and research, sellers also carry legal obligations. These disclosure requirements are designed to protect buyers from unexpected surprises—and in some cases, costly repairs or legal battles.

So, what exactly are sellers required to tell you before you sign on the dotted line?

Known Defects Must Be Disclosed

One of the most universal requirements is that sellers must disclose known material defects. These are issues that significantly impact the property’s value, safety, or usability. Examples include:

- Roof leaks or structural damage

- Mold or water intrusion

- Electrical or plumbing problems

- Foundation cracks

- Pest infestations

Even if the home looks picture-perfect, the law expects sellers to be upfront about hidden issues they ar...

What Is Eminent Domain? A Property Owner’s Guide

For many property owners, few legal concepts are as unsettling as eminent domain. The idea that the government—or in some cases, a private entity acting under government authority—can take private property for public use may seem alarming. Yet eminent domain has long been a part of property law, balancing individual ownership rights with the needs of society. Understanding how it works is essential for any property owner who may face this situation.

Defining Eminent Domain

Eminent domain is the power of the government to take private property for public use, provided that the property owner receives just compensation. This authority stems from the Fifth Amendment of the U.S. Constitution, which states that no person shall be deprived of property without due process of law, nor shall private property be taken for public use without fair payment.

Public use is broadly defined. Traditionally, it included roads, schools, and government buildings. Today, it can also extend to utilities, ...