What Happens When Family Members Disagree on Medical Care?

Medical emergencies are stressful enough. When family members disagree about what care a loved one should receive, that stress can quickly turn into conflict. These situations are more common than people realize, especially when decisions must be made quickly and emotions are running high.

Understanding how these disagreements unfold and how they’re usually resolved can help families navigate them with less damage and more clarity.

Why disagreements happen

Family conflict around medical care often starts with different interpretations of what’s best. One person may focus on preserving life at all costs, while another prioritizes comfort or quality of life. Past family dynamics, guilt, religious beliefs, cultural values, or unresolved relationships can also influence opinions. In many cases, disagreement isn’t about the medical facts but about fear, love, and the pain of potential loss.

The role of the patient’s wishes

When a patient has clearly documented wishes, such as a living ...

The Most Important Questions to Answer in Your Living Will

A living will isn’t just a legal document. It’s a way to speak for yourself when you can’t. If you’re ever seriously ill or injured and unable to communicate, your living will guides doctors and loved ones on what you want and what you don’t. The challenge is knowing what questions to answer clearly so there’s no confusion later.

Here are the most important ones to think through.

1. What kind of life-sustaining treatments do you want?

This is the core of a living will. You’ll need to decide how you feel about treatments like ventilators, feeding tubes, dialysis, or CPR. Would you want these used in all situations, only temporarily, or not at all if recovery isn’t likely? There’s no right answer here. Some people want every possible measure taken. Others prefer comfort-focused care if the outcome is unlikely to improve their quality of life.

2. How do you define “quality of life”?

This question is deeply personal, but incredibly important. Would you be comfortable living with sever...

What Happens if You Forget to Update Your Beneficiary?

Life changes fast. Marriages, divorces, new children, career shifts, and losses all affect how we plan for the future. One detail that often gets overlooked during these transitions is updating beneficiary designations. It may seem minor, but forgetting to update a beneficiary can lead to serious financial and emotional consequences.

What Is a Beneficiary and Where It Applies

A beneficiary is the person or entity you name to receive assets after your death. Beneficiaries are commonly assigned on life insurance policies, retirement accounts like 401(k)s and IRAs, pensions, payable-on-death bank accounts, and investment accounts.

These designations are powerful. In most cases, beneficiary forms override what is written in a will. That means even a carefully drafted estate plan can be undone by an outdated beneficiary designation.

What Happens When Beneficiaries Are Outdated

If you forget to update your beneficiary, the asset typically goes to the person listed on the account, regard...

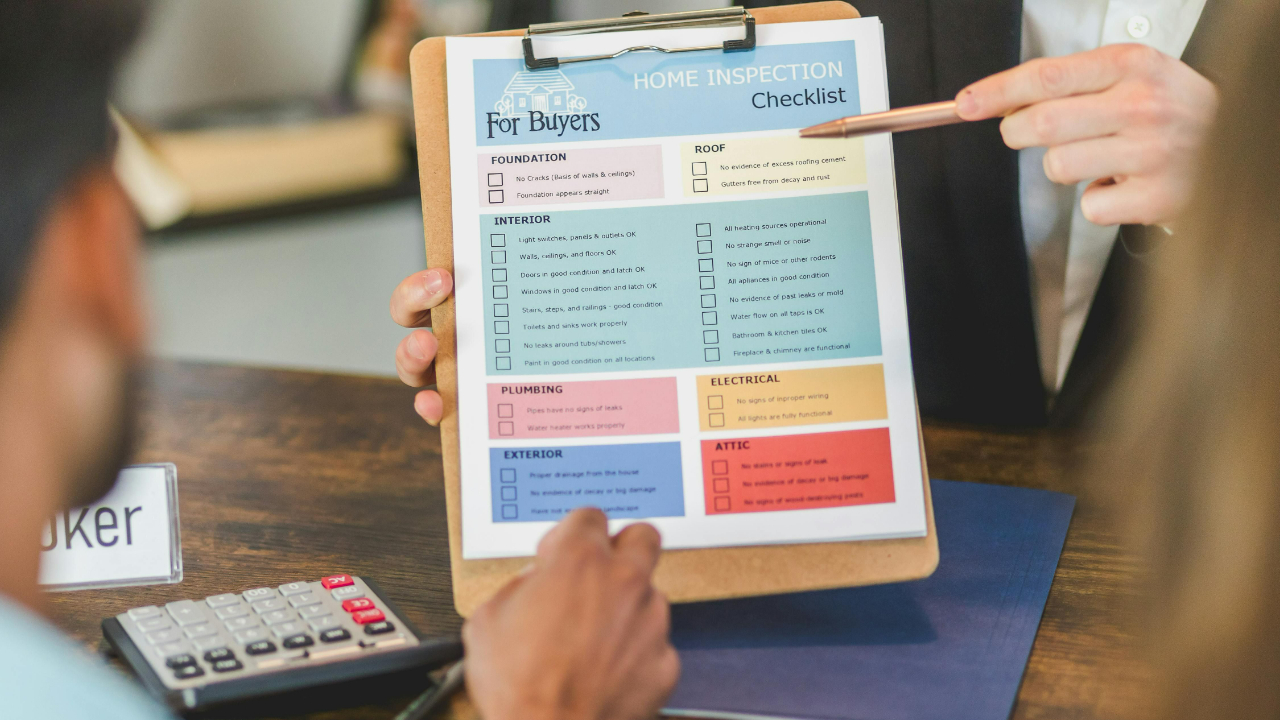

Home Inspection Contingencies: What They Really Mean

Buying a home often comes with a long list of paperwork, and one of the most important items is the home inspection contingency. While it can sound technical or intimidating, this clause plays a key role in protecting buyers and setting expectations for sellers. Understanding what it really means can help both sides navigate the transaction with fewer surprises.

What Is a Home Inspection Contingency?

A home inspection contingency is a clause in a purchase agreement that allows the buyer to have the property professionally inspected within a specific timeframe. If the inspection reveals issues the buyer finds unacceptable, this contingency gives them options. They can request repairs, ask for a price adjustment, negotiate credits, or, in some cases, walk away from the deal without losing their earnest money.

This contingency is not about finding a “perfect” home. It is about understanding the condition of the property before fully committing to the purchase.

What the Inspection Typi...

Commercial Lease Terms Every Landlord and Tenant Should Know Before Signing

A commercial lease is more than a monthly rent agreement. It sets the rules for how a business operates in a space, how costs are shared, and what happens when circumstances change. Whether you are a landlord or a tenant, understanding key commercial lease terms before signing can prevent misunderstandings, protect your investment, and avoid costly disputes down the road.

Lease Structure and Rent Type

One of the first things to understand is the lease structure. Commercial leases commonly fall into three categories: gross leases, net leases, and modified gross leases. In a gross lease, the tenant pays a flat rent while the landlord covers most operating expenses. Net leases shift some or all of those expenses, such as property taxes, insurance, and maintenance, to the tenant. Modified gross leases fall somewhere in between.

Knowing exactly which costs are included in rent and which are not is essential for accurate budgeting on both sides.

Lease Term and Renewal Options

The lease ...

Option Agreements in Commercial Real Estate: How They Work and When They Make Sense

In commercial real estate, timing and flexibility often matter just as much as price. That’s where option agreements come in. An option agreement gives a potential buyer the exclusive right, but not the obligation, to purchase a property within a specific time frame. For investors, developers, and landowners, this tool can create opportunities while managing risk, if everyone understands how it works.

What Is an Option Agreement?

An option agreement is a legal contract between a property owner and a potential buyer. The owner agrees to hold the property for a set period, during which the buyer can decide whether to move forward with the purchase. In exchange, the buyer typically pays an option fee. This fee is often non-refundable and may or may not be credited toward the purchase price if the deal closes.

Unlike a standard purchase agreement, an option does not force the buyer to buy. It simply reserves the right to do so under agreed-upon terms.

Key Components of an Option Agreem...

What Happens When Heirs Don’t Want the Business?

For many business owners, the assumption is simple: one day, the business will be passed down to the next generation. In reality, that plan does not always line up with what heirs actually want. Children may have different careers, different interests, or different ideas about work and lifestyle. When heirs do not want the business, it can feel personal, disappointing, or even frightening. But it does not have to mean the end of your legacy.

This Situation Is More Common Than You Think

Modern careers look very different than they did a generation ago. Many heirs have built lives outside the family business long before succession conversations begin. Some may not feel prepared to run a company. Others simply do not want the responsibility, risk, or time commitment.

Recognizing this early is a gift, not a failure. It gives business owners more control and better options than discovering it during a crisis.

The Risks of Ignoring the Reality

When owners assume heirs will “figure it ou...

When Should You Start Planning for Business Succession?

Business succession planning is one of those topics many owners know they should think about, but often push aside. It feels distant, uncomfortable, or unnecessary when the business is running well. The truth is, the best time to plan for succession is much earlier than most people expect. Waiting too long can limit options, create stress for family or partners, and put the business you worked hard to build at risk.

The Short Answer: Earlier Than You Think

Ideally, succession planning should begin as soon as your business becomes stable and profitable. This does not mean you are preparing to leave tomorrow. It means you are thinking ahead and putting guardrails in place. Many experts suggest starting at least five to ten years before you expect to step away. That timeline gives you flexibility, room to adjust, and time to develop the next generation of leadership.

Unexpected events do not follow a schedule. Health issues, economic shifts, or personal changes can force decisions quic...

What Buyers Should Know Before Signing a Residential Real Estate Contract

Buying a home is exciting, but the contract you sign carries long-term legal and financial consequences. Before putting your name on a residential real estate agreement, it’s important to understand what you’re committing to and where you still have room to protect yourself. A few careful reviews upfront can prevent expensive surprises later.

Understand the Purchase Price and Payment Terms

The purchase price may seem straightforward, but buyers should also review how and when payments are due. This includes the earnest money deposit, down payment, and final payment at closing. Make sure the amounts and deadlines align with your financing plan.

Pay close attention to what happens if deadlines are missed. Some contracts allow extensions, while others may put your deposit at risk. Knowing these terms helps you avoid accidental breaches.

Review Contingencies Carefully

Contingencies are your safety net. Common ones include financing, home inspection, appraisal, and sale-of-current-home...

Reducing Workers’ Compensation Risk Through Strong Workplace Policies

Workers’ compensation claims can be costly, disruptive, and stressful for both employees and employers. While accidents can never be eliminated entirely, many workplace injuries are preventable. One of the most effective ways to reduce workers’ compensation risk is by establishing strong, practical workplace policies that prioritize safety, clarity, and accountability.

Why Workplace Policies Matter

Workplace policies set expectations. They outline how work should be performed, what safety standards must be followed, and how issues should be reported. When policies are clear and consistently enforced, employees are more likely to act safely and responsibly. This reduces the likelihood of accidents that lead to workers’ compensation claims.

Strong policies also demonstrate that an employer takes safety seriously. In the event of a claim, documented procedures and training records can help show that reasonable steps were taken to protect employees.

Creating a Culture of Safety

Effe...