Identifying the Right Successor for Your Business: Family, Partners, or Key Employees?

At some point, every business owner faces the same question: what happens to this company when I step away? Whether you plan to retire, pursue a new venture, or simply prepare for the unexpected, choosing the right successor is one of the most important decisions you’ll ever make. The choice often comes down to three main options: a family member, a business partner, or a key employee. Each path has advantages and risks. The right answer depends on your goals, your company’s structure, and the people involved.

Passing the Torch to Family

Many owners naturally look to family first. There’s a sense of legacy, continuity, and pride in keeping the business in the family name. If you’ve built something from the ground up, it can feel meaningful to see your child or relative carry it forward.

But family succession only works if the person is both willing and capable. Interest alone isn’t enough. Does your family member understand the business model? Have they earned the respect of the tea...

Legal Checklist for Opening a New Business in San Diego

Starting a business in San Diego is exciting. The city’s mix of tourism, tech, biotech, hospitality, and small business culture creates real opportunity. But before you open your doors, there are important legal steps to handle. Skipping them can lead to fines, delays, or even forced closure. Here’s a clear, practical legal checklist to help you launch the right way in San Diego.

1. Choose and Register Your Business Structure

Your first decision is your legal structure. Common options include sole proprietorship, partnership, LLC, and corporation. Many small business owners choose an LLC because it offers liability protection while remaining relatively simple to manage.

If you form an LLC or corporation, you’ll register with the California Secretary of State. Sole proprietors using a name different from their legal name must file a Fictitious Business Name (DBA) with San Diego County Clerk.

Read more: How to Choose the Right Legal Structure for Your Business

2. Apply for a Federal...

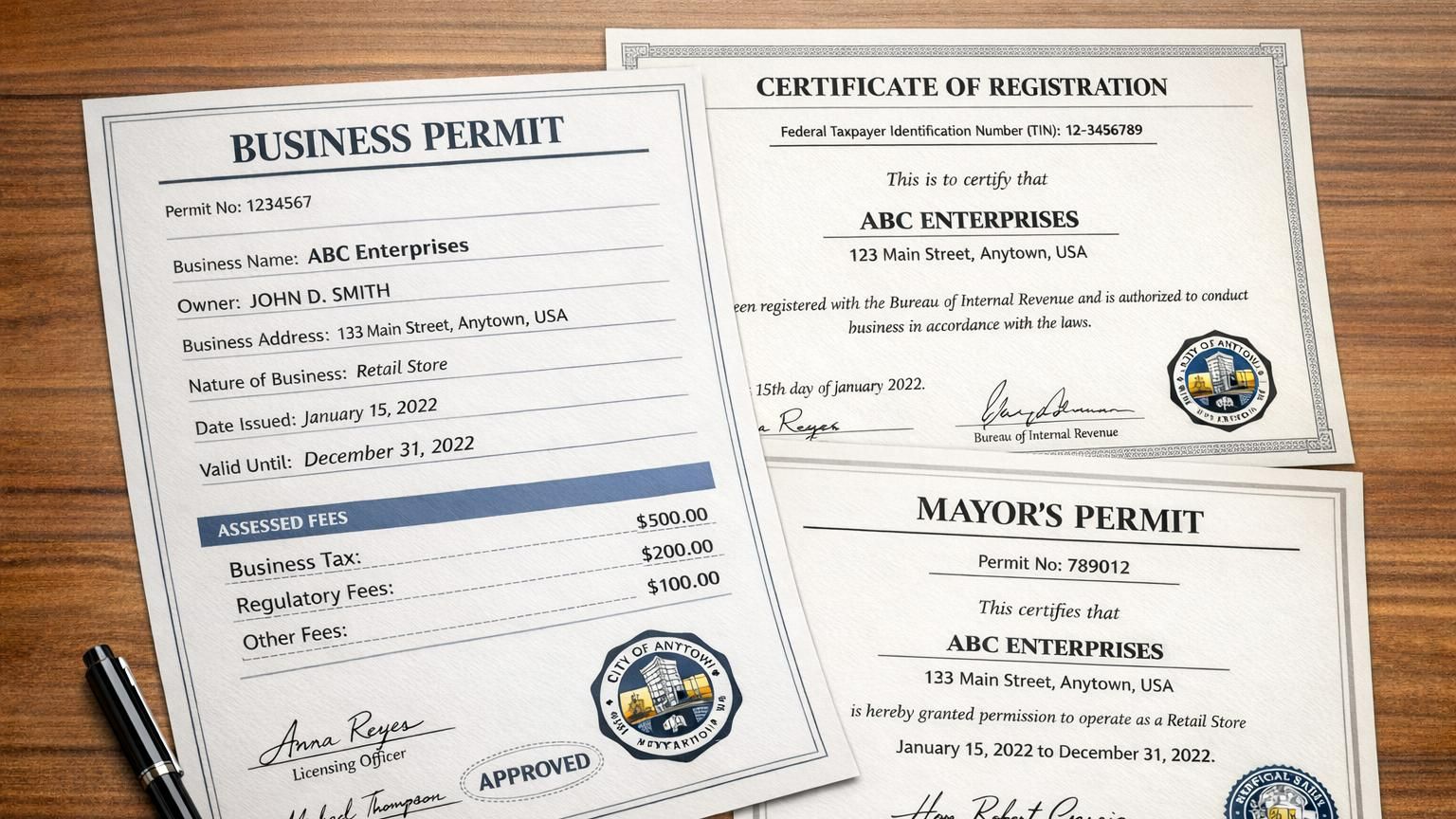

Why Proper Business Licenses and Permits Are Essential

Starting a business is exciting. You have an idea, a plan, and the motivation to make it work. In the rush to launch, licensing and permits can feel like annoying paperwork that slows everything down. But skipping or delaying them can create serious problems later. Proper business licenses and permits aren’t just formalities. They are a key part of running a legitimate, protected, and sustainable business.

Legal Compliance and Peace of Mind

At the most basic level, licenses and permits allow your business to operate legally. Different industries, locations, and services require different approvals, and those rules exist to protect both business owners and the public. Operating without the required permits can lead to fines, penalties, or even forced closure.

Having everything in place gives you peace of mind. You can focus on serving customers and growing your business without constantly worrying about inspections or compliance issues popping up unexpectedly.

Protecting Your Busine...

What Happens When Heirs Don’t Want the Business?

For many business owners, the assumption is simple: one day, the business will be passed down to the next generation. In reality, that plan does not always line up with what heirs actually want. Children may have different careers, different interests, or different ideas about work and lifestyle. When heirs do not want the business, it can feel personal, disappointing, or even frightening. But it does not have to mean the end of your legacy.

This Situation Is More Common Than You Think

Modern careers look very different than they did a generation ago. Many heirs have built lives outside the family business long before succession conversations begin. Some may not feel prepared to run a company. Others simply do not want the responsibility, risk, or time commitment.

Recognizing this early is a gift, not a failure. It gives business owners more control and better options than discovering it during a crisis.

The Risks of Ignoring the Reality

When owners assume heirs will “figure it ou...

When Should You Start Planning for Business Succession?

Business succession planning is one of those topics many owners know they should think about, but often push aside. It feels distant, uncomfortable, or unnecessary when the business is running well. The truth is, the best time to plan for succession is much earlier than most people expect. Waiting too long can limit options, create stress for family or partners, and put the business you worked hard to build at risk.

The Short Answer: Earlier Than You Think

Ideally, succession planning should begin as soon as your business becomes stable and profitable. This does not mean you are preparing to leave tomorrow. It means you are thinking ahead and putting guardrails in place. Many experts suggest starting at least five to ten years before you expect to step away. That timeline gives you flexibility, room to adjust, and time to develop the next generation of leadership.

Unexpected events do not follow a schedule. Health issues, economic shifts, or personal changes can force decisions quic...

Reducing Workers’ Compensation Risk Through Strong Workplace Policies

Workers’ compensation claims can be costly, disruptive, and stressful for both employees and employers. While accidents can never be eliminated entirely, many workplace injuries are preventable. One of the most effective ways to reduce workers’ compensation risk is by establishing strong, practical workplace policies that prioritize safety, clarity, and accountability.

Why Workplace Policies Matter

Workplace policies set expectations. They outline how work should be performed, what safety standards must be followed, and how issues should be reported. When policies are clear and consistently enforced, employees are more likely to act safely and responsibly. This reduces the likelihood of accidents that lead to workers’ compensation claims.

Strong policies also demonstrate that an employer takes safety seriously. In the event of a claim, documented procedures and training records can help show that reasonable steps were taken to protect employees.

Creating a Culture of Safety

Effe...

Why Are Contracts Important for Business Success?

Contracts might not be the flashiest part of running a business, but they’re one of the most powerful tools you have. Think of them as the backbone of every smooth partnership, project, and transaction. When expectations are clear and responsibilities are spelled out, everyone can do better work with fewer surprises. Here’s a closer look at why contracts matter so much—and why skipping them can cost you more than you think.

1. They Set Clear Expectations

A good contract lays out exactly what each party is supposed to do. It covers deliverables, timelines, payment terms, and standards of quality. When everyone sees the same agreement in writing, it reduces misunderstandings and helps projects stay on track. Instead of relying on memory or verbal promises, you have a solid reference point that keeps things moving smoothly.

2. They Protect Your Business

Contracts act like a safety net. If a client doesn’t pay, a supplier backs out, or a partner doesn’t deliver, the agreement gives you...

Legal Considerations When Expanding Your Family Business

Expanding a family business is an exciting milestone. It’s a sign that your hard work, reputation, and brand have reached a point where growth is the natural next step. But before signing a new lease, hiring more staff, or entering new markets, it’s crucial to understand the legal implications of expansion. A solid legal foundation protects your family’s legacy and ensures the business continues to thrive as it grows.

Choose the Right Business Structure

When a family business expands—whether by opening new branches, adding partners, or entering new industries—its original structure may no longer be the best fit. For example, a small sole proprietorship might need to transition into a corporation or limited liability company (LLC) to protect personal assets and simplify ownership transfers. Consult a business attorney or tax advisor to determine the best structure for your goals. This decision affects taxes, liability, and how ownership is shared among family members.

Read more: Ho...

Succession Strategies to Keep Your Family Business Thriving Across Generations

Family businesses are the backbone of many economies, built on hard work, shared values, and long-term vision. But as founders age and the next generation steps up, the challenge becomes not just maintaining success—but passing it on effectively. Without a clear succession strategy, even the strongest businesses can stumble during transitions. The key lies in planning early, communicating openly, and preparing the next generation to lead confidently.

Start Planning Early

Succession planning shouldn’t wait until retirement is around the corner. In fact, the best time to start is when business is stable. Early planning allows for thoughtful decision-making and time to mentor future leaders. Create a timeline that outlines how leadership responsibilities will gradually shift, giving successors the opportunity to learn and grow under the current leadership’s guidance. This approach reduces uncertainty and helps maintain operational continuity.

Identify and Develop the Right Successor

C...

Contract Clauses That Keep Your Business Safe During Crises

When unexpected events hit—like a natural disaster, pandemic, or supply chain disruption—contracts can make or break your business’s ability to survive. Strong contract clauses don’t just define what’s supposed to happen when things go right; they protect you when things go wrong. Here are the key provisions every business owner should understand and include to stay secure during times of crisis.

1. Force Majeure: The “Act of God” Clause

This is the most well-known crisis-related clause, and for good reason. A force majeure clause frees both parties from liability if extraordinary events prevent them from fulfilling their contractual obligations. Think natural disasters, wars, government shutdowns, or pandemics—events beyond your control.

To make this clause effective, it needs to be specific. Instead of vague phrases like “unforeseeable circumstances,” clearly list what qualifies: epidemics, cyberattacks, labor strikes, and other relevant risks. Also, include requirements for promp...